Indiana Man Receives 8-Year Sentence For Fraud Targeting Amish & Mennonites

An Indiana man who schemed Amish and Mennonite investors out of millions of dollars has been sentenced after being found guilty of fraud in May 2022. From WNDU:

SOUTH BEND, Ind. (WNDU) – A Goshen man has been sentenced to just over eight years in prison and has been ordered to pay over $2 million in restitution for his role in an investment fraud scheme.

Earl D. Miller, 44, was found guilty by a federal trial jury in May 2022 of five counts of wire fraud and one count of securities fraud. That same jury acquitted him of one count of wire fraud and one count of bankruptcy fraud. He was charged back in June 2020.

Miller ran a Ponzi-style scheme in which he collected millions of dollars from victims. Some of that went to pay the earlier “investors”, but as with all such schemes, it eventually fell apart, leaving later joiners holding the (empty) bag. Here’s more on what Miller did:

He had encouraged people to put their retirement savings into his fund, which he had no experience in managing, by advertising “double digit annual returns” and promising a fixed-rate return of 8 percent to 12 percent per year, investigators said.

Touting his Amish heritage, Miller advertised in Amish newspapers and arranged community meetings with Amish families to attract inexperienced investors, the SEC said.

Some of Miller’s clients put their life savings into his hands, the SEC said. Miller lied to them repeatedly, claiming one fund’s money would be invested exclusively in real estate but putting $391,000 into “highly speculative, fledgling companies,” according to the complaint. He also claimed one fund for investing in “green” energy products owned patents when that wasn’t true.

While Miller said he wouldn’t be paid for managing the fund, he took more than $1 million for his personal use and to buy out a former business partner, officials said.

Miller then tried to avoid responsibility by filing bankruptcy.

The Earl D. Miller case is just one of a series of frauds perpetrated against Amish and Mennonite victims, dating back 15 years. In this case Miller leaned on his Amish heritage (he was not Amish, but had Amish family roots) to build trust in the Plain communities.

This is a type of deception known as affinity fraud. Here’s a summary of the offense from a US Attorney involved in the case:

“The essence of this defendant’s crime is that he convinced people to invest in businesses by telling them a lie: that their money would be invested one way, while he used those funds in other ways,” said U.S. Attorney Clifford D. Johnson. “Mr. Miller’s crimes are particularly offensive because trial evidence showed that he perpetrated his fraud against Amish and Mennonite community members. This case shows that my office will vigorously prosecute affinity frauds.”

Miller had already been ordered to repay over $5 million in funds to his victims back in 2019. I’m not finding information on how that has gone. But I’m not too optimistic for his victims, as this latest report suggests he’s only paid around $36,000 of a separate 2018 bankruptcy agreement to return $600,000.

This latest decision requires payment of over $2 million to victims, though I’m not sure how realistic that might be given the above information, and since it sounds like Miller basically burned a lot of the money on personal expenses and purchases.

It’s a sad story when people have lost their retirement funds and life savings. On the positive side hopefully this case will serve as a warning for those attracted by future “if it seems too good to be true…” style investment opportunities.

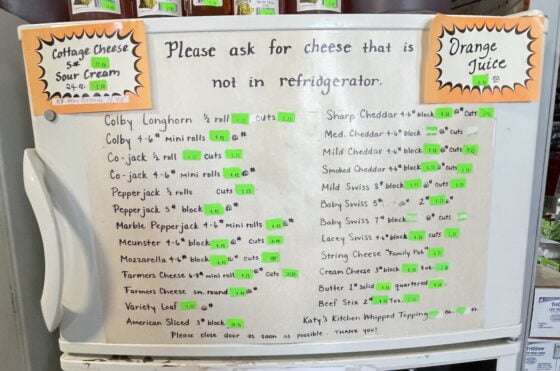

Amish Bulk Food Store

When it comes to Amish bulk food stores, Mishler’s Country Store on Barry Road in Dalton, Wisconsin, can’t be beat! At any given time, there are ten times the number of English vehicles in the parking lot than Amish buggies. None of the food items are even close to the expiration date at Mishler’s. Dry goods, such as cereals, flour, sugar, cocoa, candy, etc., are put up in varying quantities, such as 1 lb., 5lb., 10 lb., and 25 and 50 lb. sacks. There are fresh fruits and vegetables all grown locally available – always much cheaper than supermarket food store prices. As a matter of fact, the prices at Mishler’s are all better than those of the English chain stores. If one really wants to save – as do most Amish and some English – the places to look for are the Amish “dent and bent” stores. These places do not have signs out front, and look like just ordinary Amish out-buildings; one just has to know where they are. Here there are very few English vehicles in evidence. I see nothing but buggies when I shop at the bent and dents that I know of. These latter Amish stores seem more like the one in Indiana, which is the subject of this week’s column.