Amish-Backed Bank of Bird-in-Hand Doing Well

Are you surprised that the Amish-backed Bank of Bird-in-Hand has (so far) been a success?

According to an article in the Wall Street Journal, the bank has amassed more than $60 million in loans in its first year of business.

In 2013, Bank of Bird-in-Hand was reported to be the first new US bank since 2010, when the Dodd-Frank financial regulatory law was enacted.

Now in 2015, it’s still the only bank to open since then (though at least one other is planned, in New Hamspshire).

Prior to 2010, around 100 new banks opened every year. Why only one since 2010? Two sides tell two different stories:

Bankers say the drought is a sign of new regulatory requirements in the wake of the financial crisis, which are boosting expenses and discouraging potential startups from even trying. Regulators say the profit squeeze from rock-bottom interest rates is a bigger problem.

The Bank of Bird-in-Hand had significant Amish backing among its investors, and it has a lot of business among the Amish community.

Local Focus

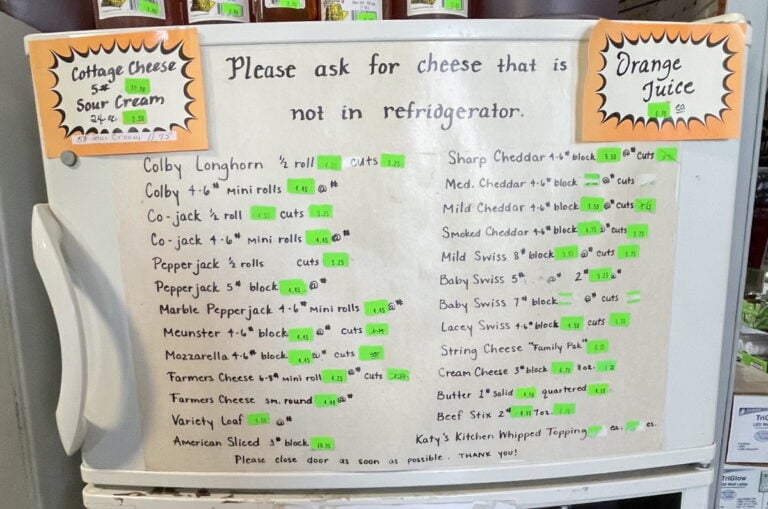

One reason for Bank of Bird-in-Hand’s early success is that it has honed in on a specific, possibly underserved market. The bank’s website states that it “maintains a strong focus on agriculture, small business and consumer banking.”

The WSJ article also suggests that the bank has kept its focus on local needs–smaller loans for farms and businesses:

The bank’s early success suggests there is a place for small lenders, but it is also in a position others would struggle to replicate. More than half of its borrowers are local Amish businesses. That group is known for being financially stable, conservative and disinterested in the types of technology that are threatening typical bank branches.

Instead of planning to cash out with a future merger, Bank of Bird-in-Hand’s board members have thought about the long run, attending FDIC training sessions before the bank opened.

The board has expanded to include banking experts from other parts of Pennsylvania. The original group had a storage-shed maker, accountant, concrete contractor and real-estate lawyer, all local.

Demand for loans has been so great that the bank’s loan officer says that “if there would have been two of me, we could have done more.”

Name change = Opportunity?

One of the most interesting parts of the story was how a name change may have led to Bank of Bird-in-Hand’s founding. This bit is detailed in a piece on the WSJ Moneybeat blog.

In 2012, a local bank called Hometowne Heritage changed its name to National Penn, after its parent company. The change got the attention of local investors, who met and decided to pursue the idea of a new bank.

An accompanying anecdote suggests that the local touch helps. One Amishman recently moved from another bank to the Bank of Bird-in-Hand, saying “I was getting to be just a number” at his previous, larger bank.

Perception starts with the name. On that level it’s easy to see the local appeal of a name like Bank of Bird-in-Hand vs. something called CitiBank or Bank of America or Nations Federal or whatever. And if you’re Amish, knowing that your people are closely involved can only add to the draw.

It sounds like a good customer base has in turn helped Bank of Bird-in-Hand become an unusual success story.

It really is all about relationships ...

QUOTE: ‘An accompanying anecdote suggests that the local touch helps. One Amishman recently moved from another bank to the Bank of Bird-in-Hand, saying “I was getting to be just a number” at his previous, larger bank.”

We have been in the town that we live in for 30 years next month. When we moved there we decided between a locally owned state bank and a locally owned national bank. We went with the state bank. Over a period of years both sold out to larger bank chains. The (formerly) state bank sold a couple of times more and finally ended up being owned by a famous California based bank that made its reputation hauling gold on stagecoaches during the gold rush days.

Over time the people that worked there all moved on and the only time that the newer employees ever called us by our names is when they were trying to sell something to us; which was virtually every time that we went to the bank. Finally, we got sick of it and started looking for another bank. To our delight, about that time the original group that had owned the state bank when we moved to our town opened a new bank & even used the same name that they had used before.

The service is excellent, the employees are friendly & helpful, plus you NEVER feel like you are just a number or a source of incremental revenue for them. I am going to retire in the next year or so and we will be moving back to the town where we both went to college. One of the things that I will really miss when we leave our current town is our bank. That sounds odd doesn’t it? How many people in this day and age can say that they have that sort of relationship with their bank? Sounds like some people in Bird-In-Hand, PA do.

I am NOT surprised about the success of the Bank of Bird-in-Hand! Too bad other businesses don’t have the same business sense to cater to individuals (local folks who do business there), not just “the masses” (quality vs quantity).

Old Kat’s post brings to mind my own banking experience. Moving to this town 26 years ago, the bank was small-town & fairly friendly. Not long after, it was bought by a well-known national bank franchise. Within a few years, I found their fees being raised so much that I couldn’t afford to keep my (and my kids—piggy bank accounts) money there anymore (I didn’t have the $10,000 threshold that earned you “no fees”—I was a stay at home Mom, my husband the main breadwinner). That bank also started catering more to businesses…customer service was only for those who could afford it, it seemed. Since then, they changed hands again.

Thankfully, a smaller (though owned by a well-known financial institution) bank opened and actually WELCOMED us smaller (less wealthy) customers. I have free checking, a couple of savings accounts…and VERY friendly staff, some of whom know me “around town”, too (we chat at local events). This bank also offers discounted day trips, free seminars, free document shredding events, and a big “cookout” in their parking lot every summer.

We should all be so fortunate to have “small-town” banks…Amish OR English.

Alice Mary

If you're in the UK - try Metro Bank

I was with the Co-operative Bank for twenty years, having moved to them originally for ethical reasons, and left when they charged me twice for the same accidental nine day overdraft, so my fees for owing them £47 for nine days totalled £40 (they justified it by saying that the nine days had spanned two charging periods).

I came across a Guardian article which cited the Ethical Consumer guide to banking, and found that Metro Bank scored substantially higher than the Co-operative, even though they don’t bang the drum about their ethical concerns the way that the the Co-operative do. My branch couldn’t have been more helpful, and they have extended opening hours 362 days a year, and when my card was stolen, I walked into the branch and emerged 15 minutes later with a new card and new PIN! Metro definitely live up to their motto of “Now you can love your bank”.

That was a cool article and follow up on the Bank of Bird-in-Hand. In New York State and other states we have what are called mutually-owned savings banks. They are run like private banks that are owned in a legal sense by depositors. I’ve had accounts at two. Both eventually converted to stock ownership and then were sold to larger banks. Nice part of when this happens is that the depositors get to purchase stock at an insider’s price. Bad part is the community usually loses a local bank.

I like online banking, electronic bill payment, and all. But I also like the idea of a bank where I can walk in and explain a situation or get a loan tailored to my circumstances.

A question for Erik or those better informed that I am on these matters: Do any Amish still reject the practice of usury? That is to say, they reject collecting or charging of interest on a loan. Several hundred years ago this was a huge issue for many Christians, it seems to have entirely faded away. I’ve found reference to Swartzenruber Amish selling farms amongst themselves at well below market prices, and to a no-interest loan society amongst Old Order that may now be defunct. Are there any Amish alternatives to the banking system? Any Christians at all that reject interest?

….How is that “nice”? To “optionally buy stock at a reduced price”? If you own 1% of the bank, then you should be getting a payment immediately from the sale of the bank! You should be suing the bank for refusing to distribute your profit as part-owner! Not to mention that each accountholder should be also agreeing to sell the bank!